Home > Research & Insights > Setting an optimal new issue premium for the EUR 700 billion issuance market, art or science?

Setting an optimal new issue premium for the EUR 700 billion issuance market, art or science?

Insights

March 2025

Setting an optimal new issue premium for the EUR 700 billion

issuance market, art or science?

Corporate bonds have emerged as a key funding source for European corporations.

In 2024, the total issuance of euro-denominated corporate bonds exceeded EUR 700 billion.

One of the primary reasons for the surge in issuance is the long period of falling interest

rates in recent decades as well as tighter bank regulations, making corporate bonds

a more attractive funding option.

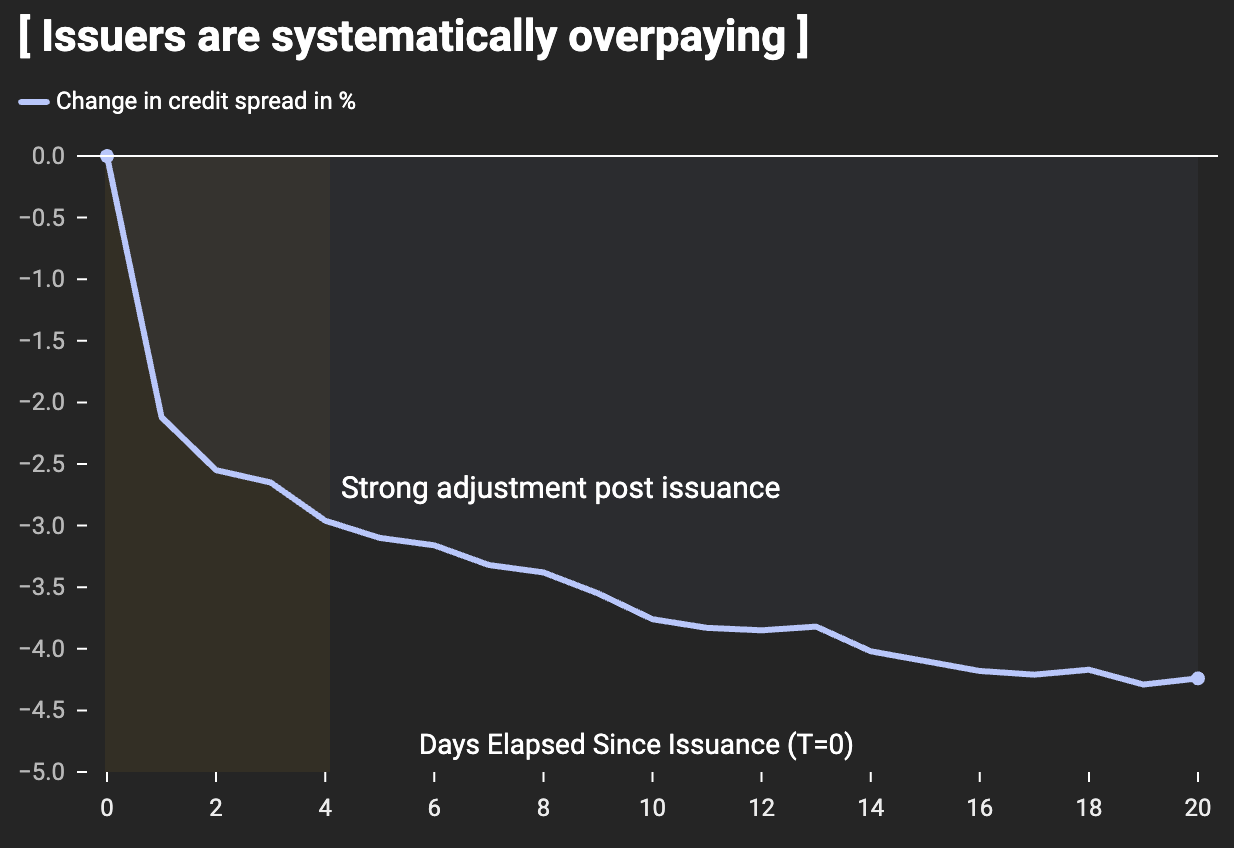

However, a closer look at the post-issuance data between 2010 and 2023 reveals that

issuers have consistently overpaid in issuance. In other words, issuers have issued

at higher yield than the optimal level based on a fair-market assessment. For investors,

this translates into higher risk-adjusted return due to higher new issue premium.

For more details on this analysis please refer to our white paper.

An issuance premium which is too high, directly impacts key financials:

higher interest expenses reduce net income, which in turn lowers earnings

per share and market capitalization for publicly traded companies.

Chart: New issue premium of EUR Corporate Bonds 2019-2024.

A new issue premium is usually granted for corporate bonds as part of a new bond issue.

The premium is an additional yield granted to investors who can participate in the

new bond issue via the "base yield" of the issuer curve. It is a necessary component

to encourage investors to subscribe to a new issue. The chart shows the corporate

bond market early secondary market development during the first 20 trading days after issuance.

The data shows the specific development of new issues and, therefore, the primary market by

adjusting the secondary market performance for the bond specific benchmarks measured by credit quality.

The curves show the specific development of new issues, adjusted and unaffected by external effects,

and, thus, the "general" development of the overall EUR corporate bond market after issuance.

How do issuers find the right issuance spread which offers an attractive new issue premium without overpaying?

The primary market issuance is the crucial transaction. it determines the ultimate funding cost over

the lifespan of the bond. This is also where the issuer has significantly more influence because

the transaction occurs directly between the issuers and investors.

By playing an active role in the issuance process, the issuer can set the new issue premium to an optimal level,

thus avoiding overpaying. As an example, one basis point of issuance premium reduction means €350,000 saving of

financing costs for an €500 million issuance with 7 years to maturity.

The fact that minimal differences in issuing returns can make a big difference in the absolute

financing costs shows the need for a professional and comprehensive methodology to quantify financing conditions and costs.

DebtRay’s analytics deliver valuable insights to issuers by offering comparative analytics

to objectively assess the efficiency of debt issuance with a focus on pricing. Our real-time analytics

help issuers assess issuance performance, while ex-ante analytics guide future issuances.

We help issuers make informed and timely issuance decisions. Our methodology is based on clean data,

a key for getting the right results and a scientific approach.

Issuers can evaluate their pricing from a market perspective, learn from past issuances,

benchmark against peers to make better decisions in the future. This benefits all stakeholders

by reducing both direct costs (e.g. higher financing costs) and indirect costs (e.g., lower ratings).

Finally, our independent issuance-specific analytics empower issuers with the confidence to navigate

key aspects of bond issuance. By providing transparent, real-time benchmarks, we put issuers back in control,

enabling smarter, more strategic decision-making.

Better Pricing, Better Timing, Smarter Issuance.

Related Articles